Not tired of the new buzzword yet? Here’s a new report on it.

Digital Consumer Trends & The “New Normal” Landscape

The pandemic coined the phrase “the new normal” and basically have given way to the launch of many marketing campaigns, catchy phrase words and fresh content relating to the world’s new state of adjusted normalcy.

Endless articles and data driven reports have mentioned this “new normal” state. Yet, consumers aren’t tired of it. As we all need to navigate this newly adjusted landscape (some countries more than others), it’s important for business owners, brands and marketers to understand just how much consumers’ preferences have shifted in the wake of the pandemic.

And when will we ultimately reach that post pandemic state?

Facebook x Bain Consulting: Southeast Asia digital consumer trends that shape the next normal

Facebook and consulting firm Bain teamed up again this month to publish a report on the “next normal” wave of consumers. We scanned the pages, studied the charts just so you don’t have to.

Here are the main bites from the Facebook x Bain report

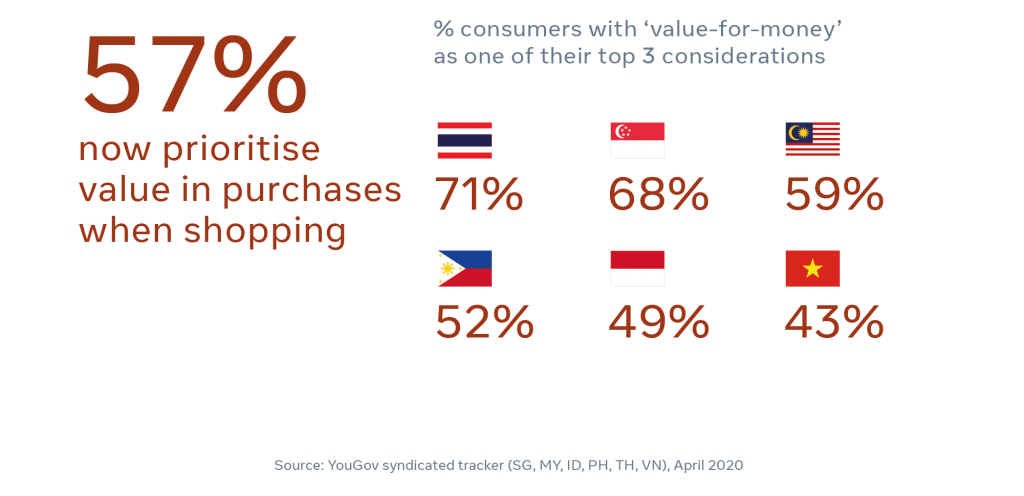

People are more price conscious

According to the report, Southeast Asian shoppers will generally become more price conscious when out shopping, with Thailand taking the lead in this one as 71% of respondents said “value for money” will be in their top 3 considerations before making a purchase. That’s not surprising, as the pandemic has re-aligned consumer priorities (even though it seems like domestic vacations are completely back). Singaporeans are also prioritizing value before making a purchase.

The trend is likely to continue, as Southeast Asians say they expect to be less materialistic, save more and take out more insurance in the new normal, according to the report.

Netflix & Takeaway, please

Consumption has moved online, especially for groceries, food, remittances, and fast-moving consumer goods. For now, the future lies in a contactless customer journey – Joo Hock Chua, Vertex Ventures

Up to 77% across the region are now preparing food at home more often, while at least 65% are watching more on-demand and even TV. Southeast Asians are typically more likely to go out for a meal than their US counterpart, (1.5x more likely than to dine out daily), but now things might change for a bit.

20% of Southeast Asian consumers said they were likely to “go out” (e.g. eat out/ go to cinemas) more when restrictions lift. At least a third of respondents to the survey felt more productive when working from home and felt that doing so has improved their mental health and stress.

What else? More people will be using “contactless” payment methods in Southeast Asia, even in cash dominant markets. In the Philippines, mobile payments app GCash has seen a 30% increase in transaction volumes since March. The reason? It’s much more sanitized.

People are discovering new apps on the reg

Consumers are turning to digital devices to keep themselves occupied when they were stuck at home. This also explains the crazy surge that online gaming platforms have seen, as well as Nintendo Switch’s sales surge, to the point that its console was listing for twice the original price on marketplaces like Lazada.

Mobile apps also had its moments. Across the region, 85% of respondents said they have tried new digital apps during Q1 this year.

Apps that have seen the highest increase in first-time and continued usage are social media, video streaming, and instant messaging apps.

Why go out for groceries at all?

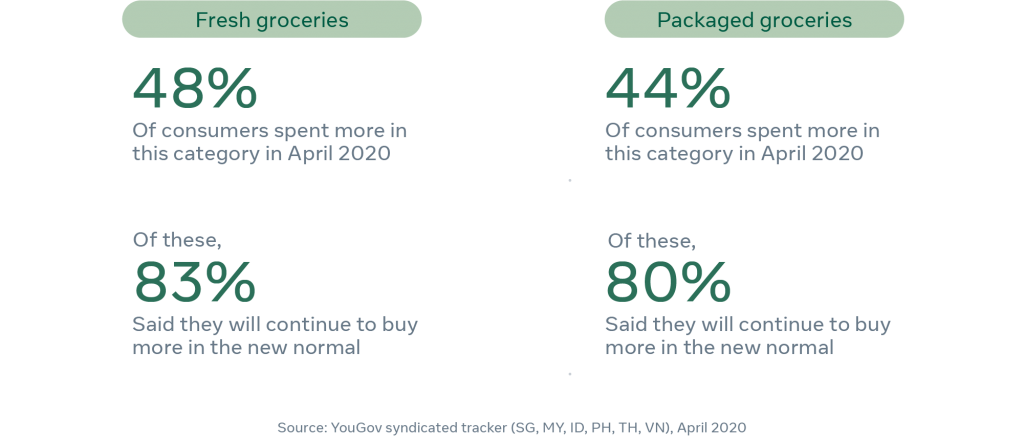

So the survey above shows that people really like to buy groceries…Okay, apart from that, the shift to online purchases have particularly been evident in the “essentials” segment, like milk, snacks and bread, probably. Even though supermarkets are deemed as essential business, at the height of the pandemic, most people with choice would have wanted to avoid exposure.

Also, isn’t it more fun to shop for snacks in your sweatpants with a glass of wine by your side?

According to the report, at least 44% of digital consumers across Southeast Asia have spent more on packaged and fresh groceries online. Online, fresh groceries have grown 3 to 4 times while the sale of packaged essentials has increased by at least twice, according to Singaporean grocery retailer FairPrice.

Key Takeaway

Trends are still evolving. For us, a lot of the “surged” trends, like online shopping and a preference for food delivery apps has been seeing high adoption rates already in Thailand, but the pandemic has simply accelerated its growth. Consumers are fickle, we all know that. In countries where the virus has dropped considerably and restrictions lifted, consumers appear to have returned to their pre-pandemic routines (with masks on and alcohol sprays at the ready), but businesses will have to remain two steps ahead in order to keep up with changing consumer demands. With high online adoption, multi-channel retail and services will remain top priority.

And who knows, consumer demands may shift completely again within the end of the year. The key takeaway though? Businesses will have to be quick on their feet to adapt. Agility, resiliency and finding your core values has never been more important.

Source: Facebook Business