After what felt like a highly contested, hotly anticipated US Presidential Election week, Democrat Party’s Joe Biden has been named the new President Elect and the incoming 46th President of the United States.

Last week, we wrote about how markets may react to election results, and this week we can say with more clarity that markets across the world are satisfied with a Biden win.

Whilst markets are also going gaga over Pfizer’s vaccine news, the impending US Presidency has set the tone going into the year end.

Even Thailand’s SET, which has been somewhat muted since the pandemic hit through to daily political protests, saw a 3% jump following election day. It’s nice to see consistent days of green for Thai investors, even if the political landscape in our own country is still on very shaky and uncertain grounds.

We’re going to be making sense of the post-Biden surge across markets and also explain why bitcoin prices have been going up. Let’s get to it.

Markets react

There was a hefty stock rally before and then after Biden won the Presidency. However, investors are still anticipating the potential senate gridlock with the Republican Party in majority.

“It’s what happens in the Senate race that could determine the next move up or down,” said Michael Hewson, chief market analyst at CMC Markets.

On the flipside though, a Republican heavy senate could mean less regulations and corporate tax decrease.

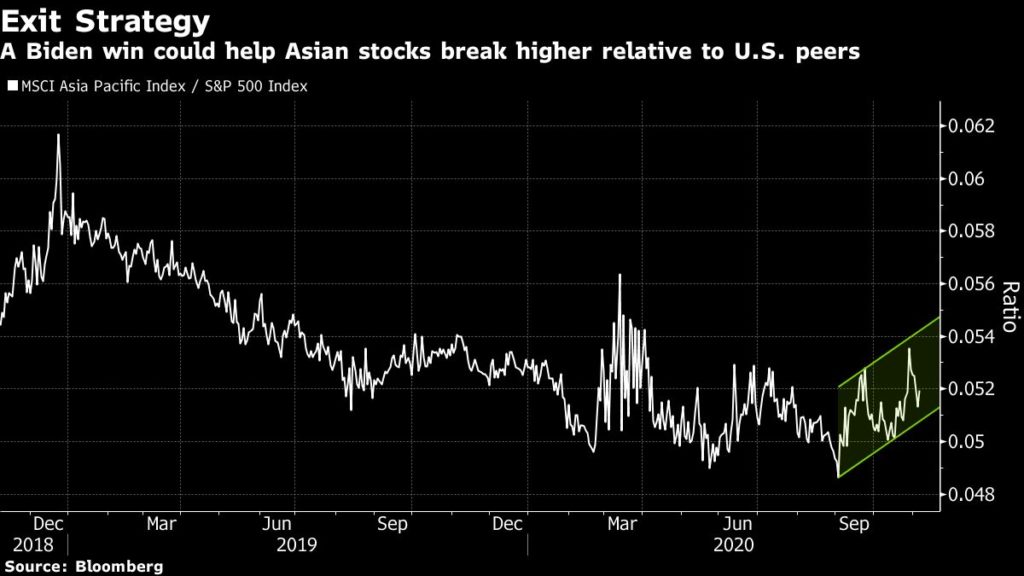

For now, Futures tied to the S&P 500 gained 1.3% and Contracts linked to tech-heavy Nasdaq-100 climbed 1.7%. For Asian markets, like Japan and China, the fresh new approach to foreign policy sounds like good news for export centric economies.

Equities outside the US also jumped to the news. Why? It is a common understanding that a Biden Presidency means clearer foreign policy direction, without irrational tariffs. Globally, there’s just a general clarity and consensus on what’s coming next; a new page has been turned.

What are investors looking for next? How President Trump reacts in the next few weeks and whether he demands recounts and to take the processes all the way to the very top.

Oil price

Oil price has been under pressure. When Biden’s win was announced, there was an increase in buying pressure which led to an increase in crude prices. Let’s take a step back.

A Biden Presidency means re-joining the Paris Climate Agreement, addressing climate change and renewable energy sources, which is good for energy stocks but fundamentally less bullish for oil.

A Biden Presidency also means more pro-environmental policies, such as raising fuel efficiency standards and supporting alternative fuels such as renewable energy, as well as supporting technological advancement to improve fuel efficiency standards for vehicles.

There should also be policies that benefit fuel efficiency for vehicles.

Ultimately, a Biden Presidency fully believes in the threat of climate change, and that a transition from fossil fuels can lead to economic opportunity-but only if the US manages to move fast enough to become a leader in the clean energy space.

This notion alone should give the markets an indication of how things will be moving.

SET listed TASCO (Tipco Asphalt)- Thailand’s largest asphalt producer – saw significant losses in Q1 2020 due to a sharp fall in oil prices. Recently, its share price has been surging due to Q3 earnings and of course, with the news of Biden’s win. Its stock surged by 11% after election day.

How come? A Biden Presidency means likely discussions with OPEC-members Iran and Venezuela. If you’ve been following oil news, TASCO was ordered by the US State Department to wind down crude oil procurement from Venezuela by the end of this month, bringing with it many complications.

Now, although it has not been resolved, a Biden Presidency could mean there’s light at the end of the tunnel.

Bitcoin

This week, bitcoin pretty much blazed through $15,500, leaping by almost 17% in a three year high. Now, is this actually related to the Presidential election? Some analysts say there’s a good chance. Here’s why.

A Biden Presidency is projected to drive the US dollar lower, which is beneficial to digital assets.

When the value of the dollar declines, investors will naturally start looking for alternative assets. This is not only a boost for bitcoin, but for other assets such as gold and silver.

Currently, the US senate is projected to lean towards a Republican majority (although its close), and what this means is that Biden will have to push bills and legislations past a Republic majority, which is not an easy feat. What this could lead to is the interference of the Fed in order to support the economy, hence lowering the value of the dollar and maintaining low interest rates.

This, in turn would be beneficial to bitcoin price as investors seek for alternatives beyond the dollar.

According to investors bullish on bitcoin, “there’s no other currency right now that’s as good at diversifying cash holdings and acting as a safe haven,” said Bill Noble, a chief technical analyst at Token Metrics, an investment research platform for digital assets. This is true to the point that corporations are taking a good, long-term view at digital assets. Even Paypal has decided to add cryptocurrency storage to its platform.

Bitcoin whales appeared optimistic about bitcoin. Election day saw 58,861 BTC moving out of Binance. That’s about $816 million. It could have been the result of a deal but it could also be whales preparing for a price rally. When whale funds move in profit to other whale wallets rather than exchanges, this often indicates that whales foresee an uptrend.

Keep in mind, these are all scenario runs. In the near future, bitcoin could react badly to a Biden Presidency – who knows.

What does a Biden win mean for the Thai market?

Not as much as you would think. However, traders are probably enjoying the continuous green rally on SET, with the market surging about 30 points since election day up until Monday.

On Monday morning, the SET shot up 27 points, about 2% gains from Friday.

Other Asian markets reacted positively to the news, with Japan’s Nikkei 25 and the Shanghai index also up about 2%. Across the board, the big companies like banks and oil giants are enjoying most of the upside as they are up not from any domestic boost, but purely from a global gain. What does this suggest? That if domestic uncertainty intensifies, Thailand will lose out on the rally pretty quickly.

Although Thai investors will see some positive relief from Biden’s Presidential win this week, our domestic politics is far from being solved or even adequately addressed by the government, which remains a cause of concern for foreign investors.

One thing that may be beneficial for Thailand in the long term, is a renewed multilateral approach to China, which will focus on less tariffs-more talks. A Biden Presidency is expected to return the US to a more rules based-free market trade relations.

But it doesn’t mean that things will be easy.

The competition between US-China, particularly in the area of intellectual property and technology will still be very present. Biden will not be expected to go soft on China, but relations should be less hostile.

In turn, US-China trade relations have implications in Southeast Asia. Whilst on-going trade disputes could improve competitiveness for Thai products, it will most likely benefit the likes of Vietnam more than it does us. A friendlier US-china duo should lead to stable production for Thai manufacturers in certain sectors as well.

Thailand’s exports value in Q1 2019 contracted by 4%, due to the impacts of trade protectionist measures between US and China. Whilst the US-China trade war did not directly impact Thai exports, the protectionism meant that global trade became vulnerable and slowed down Thailand’s trading partners’ economies.

Thailand is likely to remain China centric, with RECP negotiations still going on as well.

Key Takeaway

What’s the ultimate key takeaway from all this? Ultimately, the global sentiment is that a Biden Presidency will be more positive for the world. This doesn’t mean that the US will become soft on foreign policy or anything of that sort, but it is expected that negotiations will be more productive, with less threats and sanctions, and global trade potentially getting back on track.

For Thailand, the SET has seen days of surge due to developments from global headlines; with the Presidency and Pfizer’s vaccine success (with the market up by 4% yesterday). However, to fully enjoy the fruits of global development, we must also prioritize our own domestic politics and resolve the impending conflicts sooner than later. The government will also need to get back to work in figuring out where Thailand can thrive in a post-Covid economy.