Have you ever thought of owning a real estate and collecting rents from such property, but the initial investment cost is too high and you have so little time to manage? Investing in REIT might be the investments you are looking for.

By bundling properties together and packaging them into a single, simplified investment, REITs allow investors access to the real estate market that can sometime be too complicated to take on alone whilst balancing other things.

Disclaimer: Bitesize does not make investment recommendations. All investments comes with varying degrees of risk. Read, research & explore which kinds (if any), suits you best!

What is REIT?

First off, REIT stands for Real Estate Investment Trust, which is a trust that raises money from public (unit-holders) and uses such proceed to invest in income-producing real estate(s). Once REIT invests in such property, REIT will own the asset for perpetuity or have the right to use the asset for a specific period of time, and trust unit-holders then become indirect owners of the property through REIT.

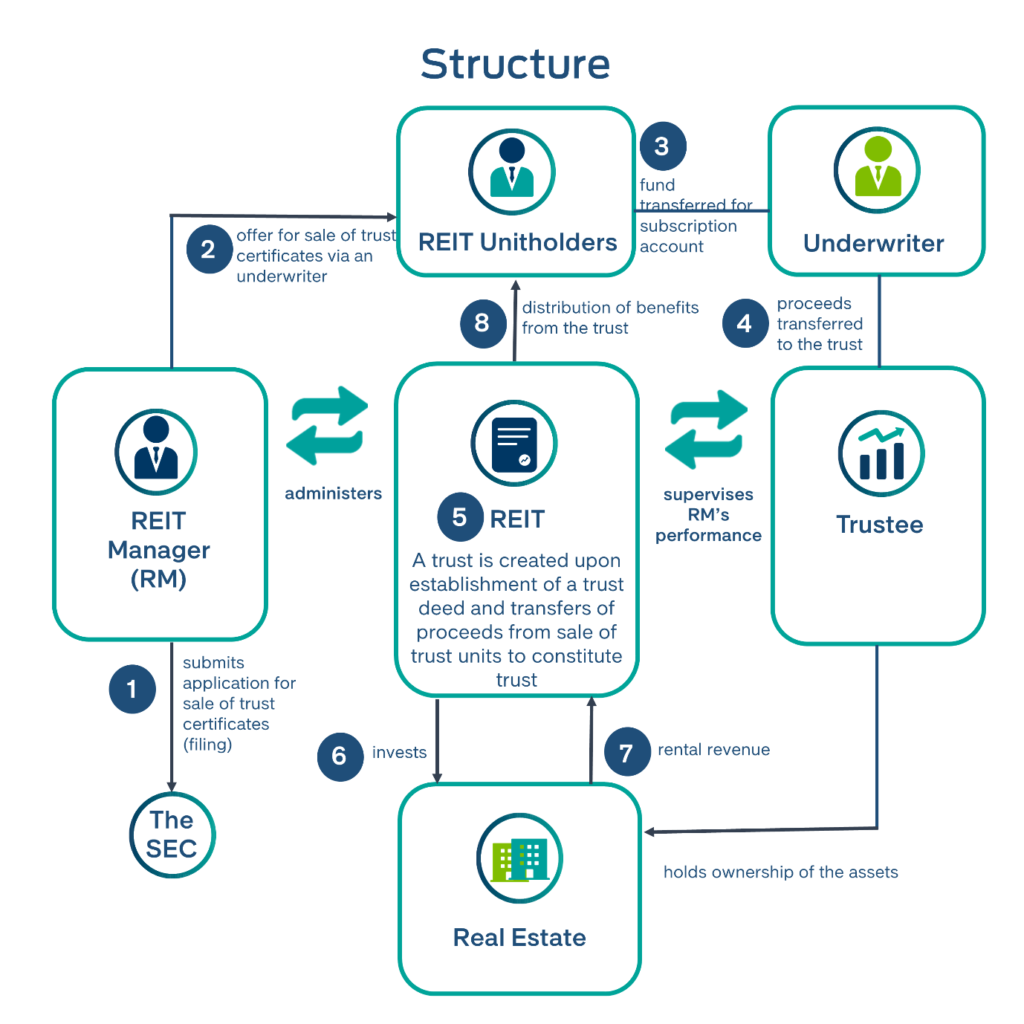

Basic structure of the REIT is comprised of REIT manager, similar to fund manager of mutual funds, who manages the REIT, trustee who supervises the REIT manager on behalf of unit-holders, and property manager who manages day-to-day operations of assets (refer to figure below). The seller will no longer relate to the property unless he becomes a unit-holder and/or a property manager and/or tenant.

Basically, the business model itself is straightforward. REITs own properties. These properties generate rents that are paid by tenants. And these rents are then passed to the shareholders in the form of dividend.

The business model is simple, but here’s where it gets more complex; a REIT owns hundreds of millions (if not billions) worth of property, from apartment buildings to warehouses and literally any kind of property you can think of. This means, balance sheet and management varies. You really have to assess the quality of the REIT’s management, with good discipline in capital allocation.

Bitesize Note: Some of you may know of the term REIT from a couple of months back when Phuket luxury hotel Sri Panwa became caught up in the political firestorm. It was revealed that Thailand’s Social Security Office had invested in Sri Panwa’s REIT. That’s another story for another time.

How does REIT earn revenue?

As mentioned, REIT invests in income-producing asset(s) so it collects rents every month. After deducting related-expenses such as operating expenses and management expenses, but not corporate income tax (as key advantage of REIT is the entity is exempted from CIT), REIT will distribute at least 90% of the adjusted net profit. Therefore, the amount of dividend that unit-holders will receive is mainly based on the performance of underlying asset(s).

What assets does REIT invest in?

Key investment criteria are investment scheme and asset type.

REIT can invest in either a freehold or a leasehold right. While freehold right means the ownership of the asset, both land and buildings, is completely transferred to REIT, leasehold right means a specified-period lease from the owner with no transfer of ownership and the asset goes back to the owner at the end of the lease. In sum, freehold is perpetuity, but leasehold is definite.

Generally, most assets in REITs are fully-grown ones with mature operations and high occupancy rate.

Qualified assets for REIT investment can be any types of properties with recurring income such as rent, with examples in the market being warehouse & factory, office, retail space, hotel, exhibition center and airport. Thus, apart from ownership type, what investors should focus when evaluating REITs is asset quality, ranging from the ability to retain existing tenants or attract new tenants to the ability to increase the rents. As major risk of REITs is tenant’s contract renewal that will mainly affect the future cash flows of the assets that will ultimately flow to REITs.

Why invest in REIT?

REIT can be viewed as a hybrid product falling between debt, or bond, and equity in the sense that investors can expect recurring income, from secured contracts with tenants, just like interest, at the same time, have to bear both upside and downside risk of the actual asset performance, just like stocks.

With these characteristics, dividend yield (last-twelve-month dividends over price) might be helpful in assessing REITs.

Due to some accounting standards, REIT sometimes has cash balance over adjusted net profit. In order to distribute the excess balance, REIT has to reduce capital in addition of paying dividends. Therefore, dividends of REIT are paid in terms of dividend and capital reduction. However, one thing to keep in mind is that past dividends do not dictate future payments, instead the current performance along with the outlook of the asset(s) should be evaluated before making investment decision.

In addition, investing in REITs does not require as much initial investment as investing in real assets and investors do not have to bother managing day-to-day operations as the management team will take care of all this.

Besides real estate, investors can also choose the REIT with the industry exposure they prefer, for example, hospitality, industrial, and retail.

Some REITs also invest in several assets in various locations which help to diversify the risk. Overall performance is disclosed in prospectus as well as annual report for screening and monitoring.

Its worth noting though, that investors should also do an in-depth analysis of the type of REIT fund they’ll want to put money into. First of all, its vital to take a close look at the management structure and whether they’ll heavily involved and disciplined in the capital allocation process. Secondly, think about what kind of properties will thrive in different market conditions. For example, a REIT with focus on office spaces may expect consistent revenue steam, but a REIT that specializes in department stores could be vulnerable once an ecommerce player takes a significant share of the market, for example.

The rise of non-traded REITS, post pandemic

Non-traded REITs have been around for more than 20 years, according to the Wall Street Journal, but the new funds are structured differently with lower fees and better disclosure.

This is probably why open-ended funds, known as nontraded real-estate investment trusts, and run by big firms like Blackstone Group are doing well with new products that typically take investments of as little as $2,500 and pay dividends above 5% without the stock market volatility.

Undoubtedly, REITs took a hit during the pandemic, but now that investors are taking a deep breath and understand the new reality of the markets, investments are coming back and funds are seeing less redemptions.

Some investors also feel these funds may be positioned to take advantage of steep discounts which are expected in the commercial real-estate market, according to the Wall Street Journal.

These newer funds have invested in sectors that haven’t been too badly hit by the pandemic. 30% of newer funds in the US invested in the industrial space, which fared well due to the sharp acceleration of ecommerce orders and deliveries. 33% have been in rental apartments. 7% invested in retail, which of course-were and continue to be hard hit.

Nevertheless, investors have the flexibility to choose. These kinds of funds may suit your investment style better rather than traded REITs-you just have to dig deeper.

How to get started with investing in REIT’?

REITs are publicly traded in the Stock Exchange of Thailand (SET) and can be purchased and sold anytime, same as stocks. REITs are listed under ‘PF&REIT’ sector in the SET, so simply filtering that to have a list to begin with. Initial investment amount is based on one’s appetite as generally, the IPO price of REITs is 10 THB per unit and the market price of a REIT unit usually does not exceed 20 THB per unit.

Thus, the investment can start with only a little amount of money. Besides direct investment in each REIT, indirect investment by purchasing funds that focus on investment in REITs is the other choice to have an exposure in REIT.

So now you have it, a quick introduction to the world of Real Estate Investment Trusts. Now that you have the basics down, how about going a bit further to see if this investment type is suited to you.

Natinee Pooissarakit is a former investment banker who is now working as a business development manager at an independent REIT management firm.