If you’re a seasoned trader or an analyst, the periods right before and after an earnings report is released will probably send you into a heightened state of awareness. This is when the market gets all excited as stock prices see sharp changes when a company releases the reports. Buyers/sellers can know whether the company is meeting its earnings targets and glean other important information for their investment decision.

So, are you looking to invest in a company that’s publicly traded? As a beginner investor, reading a company’s earnings report is a significant time commitment. Some companies’ reports span hundreds of pages long and contain all sorts of jargon. Professionals hired to analyse these reports spend years honing their knowledge and expertise.

If you just want to get an understanding about a company and what it does, you don’t need to be a finance expert to read an earnings report. It is still an exercise worth doing if you are knowledgeable in an industry but do not know much about finance or accounting, or just want to learn – yet, a word of caution, don’t expect to understand everything straightaway.

What is an earnings report and why do companies have to file one?

An earnings report is a report issued by companies that are publicly listed on the Stock Exchange of Thailand. Publicly traded companies are required by the Securities and Exchange Commission of Thailand or SEC to file an earnings report every quarter, i.e. every 3 months.

These reports take time to prepare and are usually done by the company’s finance and accounting staff overseen by the Chief Financial Officer and the Chief Accountant of the company. These professionals need to be fully qualified and the reports they submit also need to be audited or reviewed by an independent SEC-approved auditor.

Companies have to file a report because they are publicly traded. When the public’s interest is at stake, regulators need to ensure that retail investors are protected from investment risks such as fraud, which would usually be uncovered through the report or having to do the report itself.

An earnings report will always consist of:

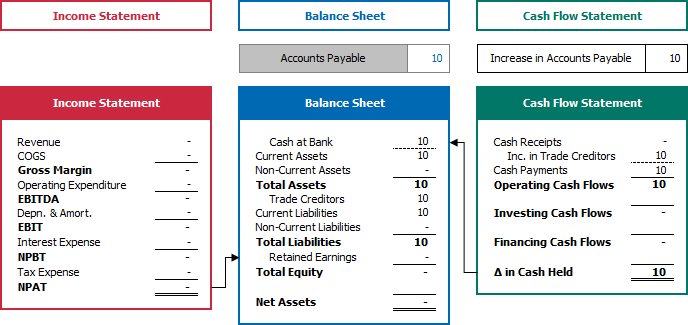

- Financial statements (income statement, balance sheet, statement of cash flows)

- Management discussions and analysis about the earnings results and overall financial condition + disclosures of market risks facing the company.

What is in a financial statement?

Financial statements include:

- Balance sheet

- Income statement

- Cash flow statement.

- The balance sheet provides an overview of assets, liabilities, and stockholders’ equity.

- The income statement primarily focuses on a company’s revenues and expenses during a particular period (for example, Q2 2020)

- The cash flow statement measures how well a company generates cash to pay debt/make investments and generally keep the business up and running.

- A financial statement is typically audited by government agencies or accounting firms such as PWC or Deloitte.

Where to find an earnings report

You can find an earnings report on the website of the company that you are intending to analyse as well as on the SEC’s website.

Tip #1: Pick up clues through the language in the management discussions & analysis

“For more than forty years, I’ve studied the documents that public companies file. Too often, I’ve been unable to decipher just what is being said or, worse yet, had to conclude that nothing was being said… in some cases, moreover, I suspect that a less-than scrupulous issuer doesn’t want us to understand a subject it feels legally obligated to touch upon.” Warren Buffett wrote this in the Preface of “A Handbook of Plain English Handbook” by the SEC in the US.

It is in the interest of management to portray a positive outlook for the company and some companies do this by conducting earnings management, which is an illegal strategy used by company management to deliberately manipulate the company’s earnings so that the figures match a predetermined target or are relatively stable – this process is also known as ‘income smoothing’. Companies do this by adding and removing cash from reserve accounts or ‘cookie jar’ accounts. It is a strictly forbidden yet not uncommon practice.

Interestingly, research has found that companies most likely to have managed earnings to beat the prior year’s earnings have management discussions and analyses that are more complex to read. Studies have also shown that it is possible to detect fraud through the language that managers use in their reports, with a 2016 study showing strong evidence.

The gist: you can glean how a company is doing from the words and language they use. Is what they’re saying making any sense? Poor language doesn’t necessarily mean the company is a bad investment but it does suggest that they are trying to obfuscate.

Researchers even use machine learning and AI to detect some of these, which of course would be too complicated and unnecessary for the everyday investor.

Tip #2: Look for red flags in the numbers of the financial statements

Prudent investing practices dictate that we seek out quality companies with strong balance sheets, solid earnings, and positive cash flows. Of course, key areas of focus should include revenue, net income, earnings per share, and EBIT or earnings before interest and taxes, which can be found in the income statement. While looking at these numbers, you’d want to look out for these red flags.

1.Inconsistent revenues & cash flows

Do the company’s revenues seem to be growing in a consistent manner? Look at the last quarter and even last year revenues – are there any sudden or unexplained changes in its revenues not accounted for in the cash flow statement? Are there any ‘other income’ or ‘gain on disposal’ items that are significant or unusual compared to previous periods? In other words, do the company’s revenues make sense or is it too good to be true?

2. Inconsistent or unexplained expenses

Are previous period expenses consistent with current expenses? The balance sheet and footnotes should provide additional information. Run through the numbers here and see if any expenses seem unproportional to the company’s revenues. If the ‘Other Expenses’ category of the Profit and Loss Statement is very high for example. Abnormally large legal fees or management trying to hide excessive travel expenses are commonly found to be concealed in this category.

3. Increasing gross profit margins

An increase in gross profit margin is not necessarily a good thing. This ratio is used to calculate the proportion of revenue leftover after deducting for the cost of making that good/product/service. If you see that overheads are outpacing it or if sales are declining it, then this could eventually lead to a loss. particularly when overheads are more than outpacing it or sales are declining, as this eventually leads to a net loss. Gross Profit Margin should be viewed together with sales levels and overheads.

4. Rising inventory or debtors in relation to sales

Rising inventory or debtors with low sales or no growth can be a sign that future stock write-downs are to follow, or that there are impending bad debts. Again, looking at the trends and understanding the business will give you a good idea of what to expect.

Tip #3: Read the fine print (i.e. notes) of an earnings report

The financial statement numbers don’t provide all of the disclosure required by regulatory authorities. Analysts and investors agree that a thorough understanding of the notes to financial statements is essential to properly evaluate a company’s financial condition and performance. “The accompanying notes are an integral part” of financial statements, according to auditors.

Whenever you see notes titled “Restructuring,” “Discontinued operations,” and “Accounting changes,” this may mean expenses drain on the company’s resources for a number of years. If they detail these costs, all the better. These long-term financial impacts can impact the company’s future earnings — which may mean stock prices will suffer and is something you’d want to consider.

Wrapping things up

After reading the financial statements, the management analyses and market information, as well as doing your own research and maybe financial modelling, you would then make a judgement as to whether the company’s stock would go up or down, and whether you should buy or sell the stock. Using your knowledge and experience as well as that of experts as a guide, you should be able to form a good opinion of the company.

Key takeaways:

- Reading company earnings reports is a time investment and requires some basic knowledge of finance and accounting to get the full picture.

- Go through the document in a methodical manner, at an appropriate level of detail.

- Do not be bogged down by the jargon; some terms require a technical understanding and as a layman you are not expected to understand everything.

- Red flags in reports involve looking at trends and major changes, expect to do some number crunching.

- Consult with industry experts to get a more informed opinion on the company and its performance.

- Stay up to date with the latest news on the industry and market trends. This will help you evaluate earnings reports and get a better understanding of what drives the industry and the company’s growth.

- Earning reports and financial statements of public companies, from Facebook to Netflix to Thailand’s VGI Group can all be easily accessed on the companies’ websites. Why not spend some time pouring over a quarterly report or two? The more you practice, the easier it gets.

For more information on earnings reports and public listed company regulations in Thailand, please visit the website of the Securities and Exchange Commission, Thailand.