Welcome back to our third and final instalment of Crypto week.

When Bitcoin emerged to the public in 2008, no one could have imagined the use cases, potential applications or how blockchain technology would evolve. Then came Ethereum, which has driven blockchain or decentralised ledger technology towards a new frontier with smart contracts and decentralized applications beyond money systems.

The adoption and understanding is still somewhat limited to niche communities and specialities, but it’s getting out there and adoption will take time.

Bitcoin’s goal was to create a decentralised cryptocurrency and system that would be stable enough as a store of value to circumvent or disrupt traditional banking systems. Ethereum on the other hand allows developers to build its platform by creating applications may or may not be related to cryptocurrency.

What’s more interesting is that there’s now a new token and stablecoin called bitcoin on Ethereum. Read on to find out more in this twisting tale of the 2 most valuable digital assets.

What is Bitcoin? What is Ethereum?

- Bitcoin enables a new payment system and is basically digital money. It is the first decentralized peer-to-peer payment network that is powered by its users with no central authority or middleman.

- Ethereum has a completely different goal as a project. On it, you can write code that controls digital value, runs exactly as programmed to be accessed anywhere in the world. Ethereum is more focused on enabling innovative applications.

- Comparing the two is a bit like comparing apples to oranges; they are different projects with different goals.

More differences than similarities between them

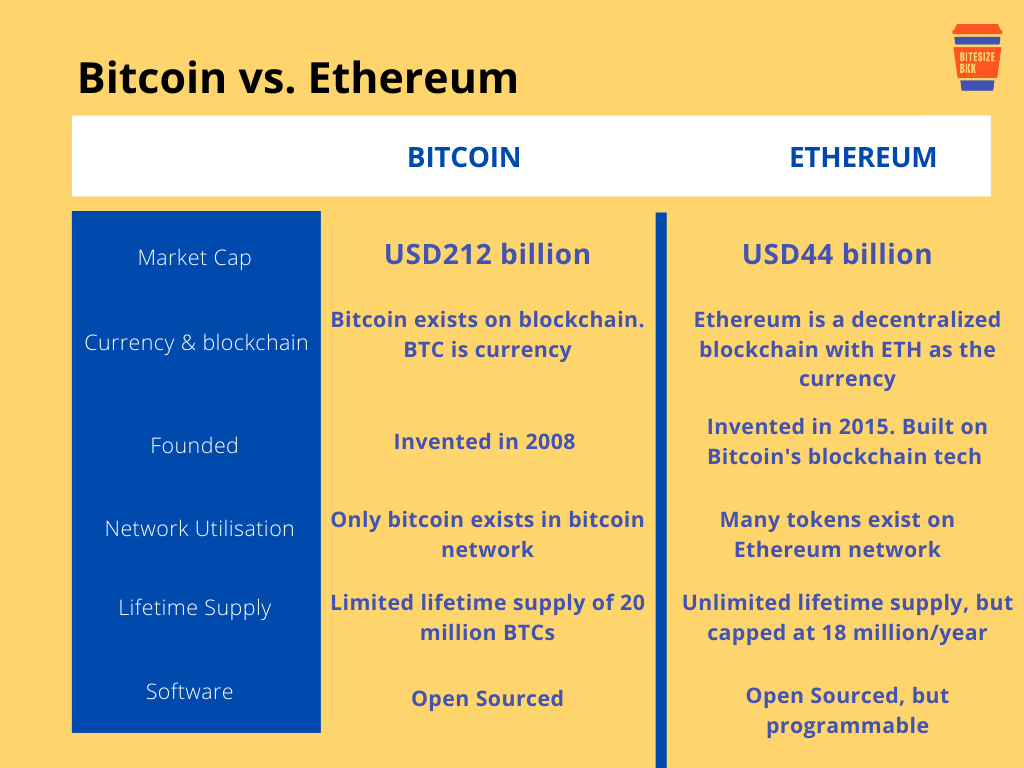

Bitcoin is still the most popular decentralised virtual currency that lives on the bitcoin network with enthusiasts seeing bitcoin as ‘superior’ with its limited supply & mainstream payments adoption.

- If we were to compare the two, we’d have to look at ETH instead of Ethereum. ETH is the currency of Ethereum, valuable to Ethereum users because they pay for transaction fees on the platform with it.

- More recently, ETH has also become valuable to users of financial apps on Ethereum because ETH can be used as collateral for crypto loans, or as a payment system.

The rise of decentralised finance (De-Fi) projects that run on the Ethereum platform has driven up the price of ETH in recent months.

- Many also see ETH as a currency with a store of value, similar to Bitcoin or other cryptocurrencies, which makes it have long-term investment potential.

- However, it would be premature to judge which cryptocurrency is ‘better’ or more valuable in the long term because no one can know what other technologies might supersede Bitcoin and Ethereum, or indeed how these technologies will evolve in general.

Twist in the story

- As a twist to this story and an example of technological innovation.

Now there’s bitcoin on Ethereum. Let’s take a step back, what exactly is this?

- This is called ‘Wrapped BTC (WBTC)’. Technically known as ERC-20 (the name for a technical standard used for all smart contracts on the Ethereum blockchain), a token backed 1:1 by bitcoin, launched in February 2019 as a joint initiative between decentralized exchange startups Kyber Network, Republic Protocol, and cryptocurrency custody company BitGo.

- WBTC is a token that is traded on exchanges like any other cryptocurrency.

What’s so special about wBTC? And how did it come about?

- Recently, several DeFi applications – such as exchanges and websites that broker crypto loans – have emerged paying attractive yields on cryptocurrencies for lending out their cryptocurrencies. Because most DeFi applications run on Ethereum (which uses ETH as payment), BTC holders are left stranded or having to rely on centralized lending platforms that generally pay less.

Hence, Bitcoin wrapped in an Ethereum token allows bitcoin holders to earn more interest off the Ethereum blockchain.

- Now, other bitcoin-backed Ethereum-based tokens have since emerged, such as tBTC. While wBTC remains the market leader for now, accounting for two thirds of all BTC on Ethereum.

- There are now over 45,000 BTC locked up on Ethereum. Even though the current BTC supply is over 18 million, which makes the proportion of BTC on Ethereum relatively low, the trend is indeed growing.

What this means for now

Ethereum will continue to encourage decentralized finance innovation, only with even more liquidity. Bitcoin on the other hand, will continue to be a digital store of value appreciated for its scarcity, only with more yield opportunities.

Key Takeaways

- The main differences between Bitcoin and Ethereum are goal of the projects and the use cases.

- Bitcoin with capital B usually refers to the blockchain while bitcoin with a small b or BTC refers to the currency. Ethereum is the blockchain while ETH is the currency.

- BTC is considered as Digital Gold, which people can use to hedge against the dollar when there is a financial crisis. ETH, on the other hand is an innovative technology that allows projects to build dApps on the Ethereum blockchain for new business models and concepts for industries ranging from logistics to finance.

- As the world moves towards greater understanding of cryptocurrencies and digital assets, there will only be more use cases and projects on the Ethereum platform, and Bitcoin should transition to be a more widely accepted store of value.