The pandemic caused a lot of us across the globe to reevaluate our relationships with money, whether you realized you didn’t have enough saved up, or that your emergency fund served you well for six months.

Covid-19 forced us to stay home, and likely allowed us time to think about the importance of saving, investing and generally being smarter with finances. However, it’s easier said than done when there’s too many resources and barriers to making your money work for you.

Enter StashAway, a digital wealth management platform founded in Singapore back in 2016. We had the opportunity to sit down with Yosakorn ‘Tim’ Niranvichaiya, CFA, Managing Director of the recently launched StashAway Thailand, to talk about the business, global ETF products to financial literacy.

Tim was previously a consultant at top tier consulting firm Bain, where he worked mainly in the wealth management and private banking sectors, providing him a front seat view to the industry.

“I witnessed the roadblocks first hand when working with clients in wealth management,” says Tim. “It was then that I realized the industry itself had barriers, something that could be better solved with technology.”

StashAway’s Secret Sauce and Story

StashAway is a digital wealth management platform that invests in a diversified portfolio of global exchange traded funds (ETFs) for its customers, with selection made depending on the current economic condition and users’ risk appetites.

The platform leverages its proprietary Economic Regime-based Asset Allocation framework (ERAA™) to reoptimize each portfolio, allowing customers to maintain their risk threshold and capture return potentials in the changing macro economic conditions.

StashAway was founded in Singapore in 2016, and now operates in five markets, including Malaysia, Hong Kong, MENA region and now Thailand. The company raised US$61 million to date, and counts notable VCs as investors, including Square Peg, Eight Roads Ventures-the proprietary investment arm of Fidelity International and most recently, Sequoia Capital India.

(Image Credit: StashAway/Tech in Asia)

The company has seen many successful milestones, including being named as a “Technology Pioneer” by the World Economic Forum in 2020. Within that same year, StashAway’s managed assets grew by 330%, despite a highly volatile global market.

As of now, StashAway manages over US$1 billion assets under management, a testament of its effective investment strategy for clients.

Don’t be fooled by the seamless nature of the platform, digital wealth management platforms like StashAway goes beyond having an app manage your money. Its ERAATM framework is able to effectively minimize the customer’s risk exposure whilst maximizing returns.

“One of StashAway’s key values is our ability to curate the most optimal ETF portfolios according to economic conditions and each customer’s risk threshold,” says Tim.

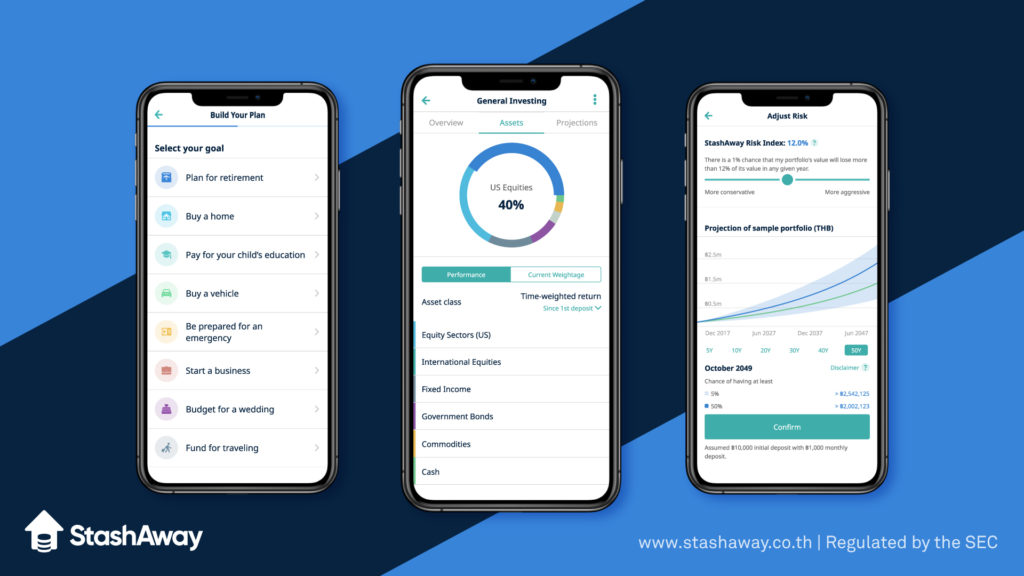

StashAway offers exposure to a range of curated global ETFs, from the S&P 500 to US technology and energy centric funds. The customer can easily access their portfolio by logging into the application and view the daily performance balance and even what funds they have exposure to according to risk level.

So, how does it differ from buying an ETF from a bank?

“Our fee structure is very transparent,“ says Tim. “Our all inclusive fees range between 0.2%-0.8% annually with no hidden costs. We can afford to do this by leveraging our efficient in-house technology”.

The all inclusive covers overseas remittance, custody fees as well as trading commission.

StashAway is regulated in all countries it operates in, such as the MAS in Singapore and the SEC in Thailand. The money is also highly secure and protected, with Kasikorn Bank as the local custodian, overseeing the client’s assets. The securities are kept with Citibank Singapore, through Saxo Capital Markets.

“Even in a highly unlikely event of bankruptcy, any money held in custodian accounts cannot be touched by StashAway. It belongs to the clients, not to us,” says Tim.

The funds used for the company’s operations are completely separated from the client’s assets.

The Tech Powering StashAway’s Investment Framework

StashAway’s proprietary technology is the engine that powers it all. The platform follows the ERAATM (Economic Regime-based Asset Allocation) investment strategy, built with years of academic and field research by experts who have managed billions of dollars themselves.

StashAway is able to proactively manage clients’ investments according to their determined risk appetite, and can swiftly change their portfolio position into allocations that generate effective returns in let’s say, a high inflationary environment.

When there is a trigger for change, a re-optimisation of the portfolio occurs.

“When economic conditions are challenging like they are now, StashAway is able to proactively help investors navigate the market,” says Tim. “Each asset class has its own return and risk profile in relation to different economic conditions.”

Putting this into context; StashAway’s ERAATM framework continuously monitors what economic regime is at play. StashAway looks at rate changes in growth and inflation, and recognizes four key economic regimes; recession, healthy growth, inflationary growth as well as stagflation-which refers to an economy with inflation, stagnant growth and a high unemployment rate.

“Asset classes perform differently in different economic regimes,” says Tim. “Between 1982 to 2017, the S&P 500’s volatility jumps in a recession, going from 14.7% in healthy growth periods to 19% during a recession.”

The key takeaway from this? StashAway optimises a client’s investment portfolio in the event of changing economic conditions, which is determined by the four economic regimes. In other words? It’s more challenging to navigate this yourself!

Navigating Through Risk with StashAway

“StashAway’s Risk Index feature is very unique and sets us apart from other players in the market,” says Tim. “The client can determine exactly how much risk they are willing to take, and can effectively manage their risk exposure with us.”

StashAway Risk Index (SRI) is the target drawdown percentage your investment portfolio should not exceed in any given year, with 99% confidence level. The client is able to select their portfolio’s SRI before investing, and determine the downside they are willing to accept.

For example, if a client selects a 30% SRI, then they have indicated that they are comfortable with a 1% chance of a 30% drawdown or more, in a given year.

“We are able to deliver such precision with your selected SRI, because we use economic data to power the asset allocation that will both perform and protect your investments,” says Tim.

”We believe that the best way to effectively build wealth is to stay invested,” says Tim. “And in order to stay invested, it’s important to understand why you have to choose the optimal level of risk that works for you.”

If people take on too much risk, they will ultimately sell off their investments during a market downturn, which defeats the purpose of long term wealth building.

This is a very important feature, because StashAway believes in being transparent about exactly how much risk you are being exposed to.

Tackling Financial Literacy is Key

For most, financial literacy is the key to achieving financial freedom and making educated decisions about your finances. For many, this is considered a luxury.

“Thailand’s financial literacy is improving, but across the country, Thais are holding too much cash,” says Tim. “About 46% hold onto cash, compared to 14% in North America.”

Whether holding cash is related to limiting risk exposure, or simply about a lack of understanding in financial products, it often becomes troublesome in the future, when people find out they cannot afford to retire, or pay for medical bills and so forth.

“By holding onto cash, you end up not having the funds to retire because the money doesn’t grow over time,” says Tim.

StashAway is also planning to launch StashAway Academy in Thailand, a service that provides a range of personal finance and investing courses and events to increase financial literacy and knowledge on investing.

“Our StashAway application itself will also provide easy access to financial advice with goal based features,” says Tim. “Users will be able to leverage the app to calculate the investment amount required for the specific goal. They will also have access to a monthly investment plan to achieve that goal, whilst maintaining the optimal risk level throughout the investment journey.”

Familiarizing yourself with the accessible tools is the first step in gaining control over your finances and becoming more involved with your own investment.

Now, for those who are learning more about investment products and opportunities, it will also lead to an interest in overseas investment opportunities.

A Gateway to Global Investment Opportunities

There’s a growing trend of wanting access to global investment funds and high growth companies. Although you can gain access through traditional financial institutions, factors such as hefty fees and paperwork can make it more complicated.

“People often view investing as complex, so it’s difficult to know where to begin especially when investing overseas,” says Tim. “StashAway provides our clients with access to global investment without any of the hassle.”

By removing these frictions to investing with technology, StashAway is well positioned to add value for their clients, and effectively provide access to global investment opportunities for Thais.

Thai people’s wealth is typically highly concentrated within domestic markets, which could have its drawbacks.

“It’s all about risk management. I always say, it’s never good to put all your eggs in one basket,” says Tim. “Investing overseas provides you with better risk management because of diversification and exposure to different sectors.”

Investing overseas also provides you with the opportunities to generate higher returns from high growth industries, such as technology and innovation.

In Thailand, oil and gas make up for almost half of the index, there’s a sufficient lack of new economy businesses and disruption drivers. The younger generation of more technologically savvy investors are more interested in higher growth companies.

Whilst you could argue that financial institutions and private wealth services also provide access to overseas investment products, there are several challenges such as higher brokerage fees and high minimums.

“The majority of Thais cannot afford private management services with high minimums. StashAway allows clients to build their wealth without worrying about hidden costs or minimums,” says Tim.

Looking Ahead

For Tim, he believes that StashAway has a lot of potential to grow in Thailand and follow the success of other markets across the region. “I believe we have only begun to scratch the surface,” he says. “The near term goal for us is to raise awareness about StashAway’s product offerings and benefits, and earn our clients’ trust.”

As for the long term view? StashAway wants to encourage people to improve their financial literacy, start learning about investing and provide education to the market beyond managing investment portfolios.

“It’s important to start early, and invest for the long term,” says Tim. “The power of compounding interest will be significant over time.”

What else?

“Diversify your investments, and don’t try to time the market because it is extremely difficult to do so effectively,” he says. “Stick to the dollar cost averaging of your investment plan to protect yourself from volatility.”

Going forward, StashAway is committed to helping clients reach their investment goals, whilst also doing their part to educate the market along the way.

For more information, check out StashAway’s website and Instagram.