Buy Now, Pay Later (BNPL) is having a series of golden moments. Acquisitions of BNPL platforms have only increased this year, from payments company Square’s US$29 billion acquisition of AfterPay, to Amazon’s partnership with Affirm, to PayPal’s US$2.7 billion buyout of Japanese BNPL platform Paidy.

The wheel doesn’t stop spinning, and the list goes on.

Buy Now, Pay Later has been around for years, but saw a refreshed boom during the pandemic when people stayed home and relied on online shopping. BNPL services are growing at a rate of 39% a year, with its market share set to double by 2023. By then, 3% of global ecommerce spend will be through BNPL services.

In Southeast Asia, the BNPL race is also heating up with more players coming into the landscape. We sat down with Poompong “Nan” Tancharoenpol, General Manager of Atome Thailand to discuss the business model, the landscape and how it feels to be one of the first entrants into the market.

BNPL 101

Atome is a leading Buy Now, Pay later platform in Southeast Asia, having launched in Singapore back in 2019. The company’s name is pronounced “A to Me”, which is essentially short for “Available-To–Me”

So, we wasted no time diving in.

“Buy Now Pay Later is exactly how it sounds,” says Nan. “A platform like Atome allows users to simply pay for their item in interest free deferred payments, whether it be a cosmetics product or a pair of sneakers.”

The value of Atome lies in the flexibility that it provides users, who can sign up with ease with just a few taps on their phone.

“Like a lot of digital trends, BNPL became very popular during the pandemic, when people relied on ecommerce and likely did not want to overspend every month,” says Nan.

The value of BNPL is that it provides flexibility on payments you know you can afford. Nan calls it aspirational purchases.

“This is the key differentiator between us and credit cards. We allow you to break down smaller purchases over the span of months, instead of having to spend all in one go.”

Smaller ticket items refers to everyday luxuries and nice to have products such as cosmetics, skincare, apparel and footwear. These are likely things you know you’ll be able to afford next month, when your salary comes in.

“BNPL is not for items such as expensive smart TVs or electrical appliances,” says Nan. “It’s for things you can probably afford today, but we add that flexibility to your monthly cash flow.”

Atome is tackling the THB2,000-3,000 price ticket, as opposed to bigger ones.

So, how does it work?

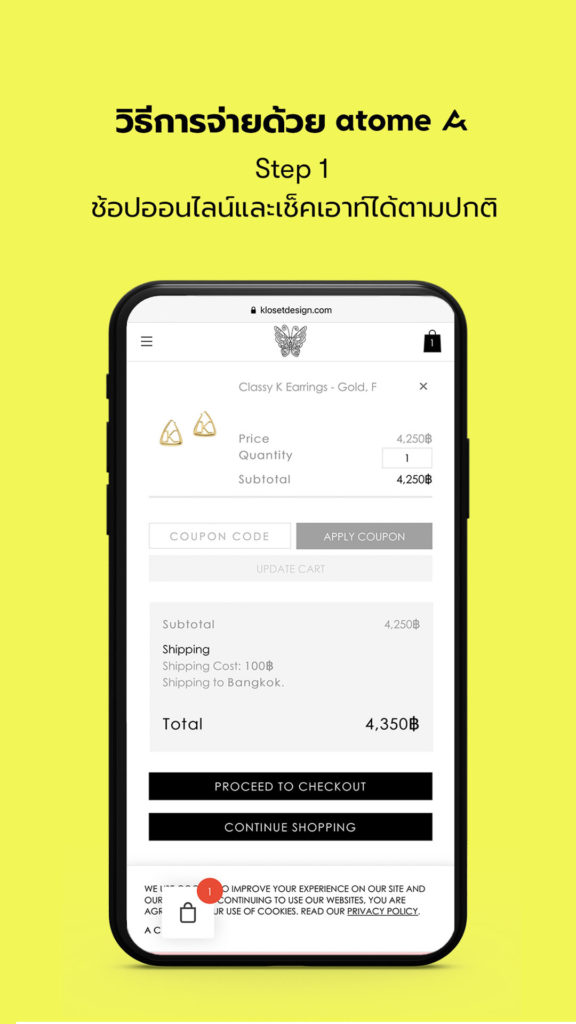

The sign up process is very straightforward. After downloading the application and filling out the necessary details, you’re more than good to go. So, when users want to use the service, it’s only a three step process.

Atome is omnichannel, which means you can use it as an online checkout feature or at a physical check out counter in store too.

If you’re shopping online, simply select Atome as a payment method and it will automatically split your bill into 3 equal payments-with no hidden fees. The first payment will be done instantly, and the remaining two will be 30 days apart.

For offline retail, customers can just scan the QR code on site and go from there.

What about after? What happens if a user misses a payment? Hint, it’s not as bad as a credit card’s penalty scheme.

“If a user misses a payment, we’ll send an alert and halt you from further spending on the app,” says Nan. “A customer’s account remains suspended until the missed payment is paid, together with the 0.3-0.5% admin fee.

This is one of the main ways we prevent customers from overspending, and another big difference vs credit cards, where the interest charges can snowball even as you keep using the card..”

Atome relies on its eKYC technology and Singapore based Advanced Intelligence Group’s AI technology to approve users, and conduct credit scoring models.

Thailand’s Atome journey

Prior to taking on the role of General Manager at Atome Thailand, Nan was the Country Head at B2B ecommerce platform Zilingo Thailand and before that, an investment manager at AddVentures, Siam Cement Group’s venture capital unit.

“When I was working at AddVentures, of course I was exposed to the emerging technologies and trends, ecommerce was always a dominant one,” says Nan. “Then, it became about the enablers of the ecommerce industry, from logistics to supply chain. Thailand is well positioned in ecommerce and logistics, but there weren’t a lot of players tackling payments.”

Then came Atome, and Nan saw the opportunity to dive right in.

“Diving into BNPL in Thailand now is probably like how it felt to start ecommerce back in 2013,” he says.

Atome is eyeing the entire landscape, and has onboarded a handful of regional and local brands already, less than a month after launching in Thailand.

“What I’m really excited about is that aside from onboarding our regional brands such as Sephora and Zara, local Thai brands have also been very receptive and we have signed on GQ apparel, Skin Lab and Thai designers such as Asava and Vickteerut,” says Nan.

The company also has plans to offer BNPL options through their partnership with Agoda, which will allow holidayers to spread out their hotel payments.

The argument on banks and credit cards….

Thai banks foster a lot of payments and financial technology innovation.

“Thai banks are incredibly competitive and well positioned,” says Nan, “as global banks such as Citi and HSBC scale down here, local financial institutions will only get stronger and their consumer products are good.”

We also talked about whether Nan expects banks to eventually enter the space to become a potential competitor, and touched on the credit card argument.

Skeptics of BNPL often say that the value is similar to credit cards, with various Thai credit card issuers also offering interest free installments on certain purchases, such as electronics. For Nan, the value BPLY offers is different.

“Credit card penetration in Thailand is relatively low. Although we have approximately 24 million cards, on average people hold about 3 cards,” he says. “If banks were to do their own version of BNPL, they may be concerned about whether that would eat into the credit card or debit card business. Also, how open would the bank’s BNPL be to other banks’ customers and credit cards?”

For independently owned Atome, customers can use any Thai-registered credit or debit card, regardless of their bank affiliation. This is actually very important from a merchant’s perspective, as it doesn’t limit them to just one bank’s customers.

Thailand’s credit card landscape is complex, with under 10% penetration in relation to our population. Credit cards are also difficult to apply for, you would need the necessary documents to do so in person, and proof of reliable pay slips. The customer journey itself is very different, and BNPL offers easier access.

“It’s an incumbent’s dilemma. They have to think about how much they want to disrupt themselves, or how willing they would be to work with new, standalone players.”

One key differentiator to credit cards is the nature of the purchases itself.

“Atome focuses on lifestyle, beauty and affordable fashion,” says Nan, “there’s actually less overlap with credit cards than you may expect. Credit cards are often kept for big ticket items.”

Thailand’s growing BNPL landscape

Currently, we have yet to see banks launch their own BNPL product, it will likely make more sense for BNPL players to partner with payment processors and providers.

This doesn’t mean the space isn’t filled with potential challengers.

Currently, ecommerce marketplace Shopee is offering its own flexible payments option through SPayLater, which allows shoppers to either pay in installments or later.

“We are aware of current and potential competitors who are looking to enter the space,” says Nan. “But I always like to focus on what I am doing, if you just watch out for competitors, you’ll never tackle the work you want to do.”

Because BNPL is so new in Thailand, Atome’s first move advantage will also mean it plays a hand in building the ecosystem. This means the company has to educate the market, incentivize the potential users and onboard brands. So far, Thai brands have been receptive to innovation.

“Local brands have been excited about BNPL and have signed on with us quickly,” says Nan. “This is great because we focused on local players, from EveandBoy to Konvy right away without just sitting on regional partners.”

Brands should see BNPL as an added perk, as they get paid in the full amount right away, and these flexible payment terms could incentivize more people to add extra items to cart, or make more spontaneous but affordable purchases.

This brings us to another point. Challengers of BNPL often say that the model could encourage overspending for millennials and Gen Z shoppers, but Nan doesn’t think that’s the case.

“We have a very transparent payment schedule that requires no racking up debt or hefty, recurring fees,” he says. “It should actually help shoppers to become more disciplined with spending, as they will know how much is owed every month and they will have to pay it off.”

Atome’s Vision

Atome only launched in Thailand a couple of weeks ago, but Nan and his team have their hands full with the business.

“Our goal is undoubtedly to grow our list of local partners, onboard more users and generally educate the Thai landscape about our product,” he says. “Educational content is very important to adoption, especially in the early stages.”

In a way, Atome’s BNPL offering may open up new paradigms for improved financial literacy, beyond being a convenient payment method for younger consumers. The structured flexibility could influence some users to be more mindful of what they can afford and how they will manage cash flow to accommodate certain purchases.

“I am bullish on the value that BNPL can create for consumers in Thailand,” says Nan. “I’m confident that BNPL solutions can enable consumers to increase their basket size by up to 30%, and allow them to effectively manage their cash flow, which will also benefit brands and retailers.”

With its estimated growth, BNPL should eventually become synonymous with omnichannel retail, which means Atome is well positioned to capture Southeast Asia’s pandemic fueled ecommerce boom, as well as support the post-Covid19 recovery of the physical retail industry.