Everywhere you look now, it seems like people are becoming savvier investors. There’s your co-worker who frantically refreshes his cryptocurrency app, your friend who is quickly diversifying her investments to save up for her mortgage, or your cousin who is shorting all the right stocks.

The pandemic has shifted various investing paradigms and outlooks, from being bullish on buy and hold to turning to technology stocks to a renewed emphasis on risk management. The bottom line is, something as life changing as the Covid-19 pandemic definitely made everyone think more about money and finances. Uncertain circumstances also means that people are trying to mitigate their risk exposure, whether through diversification or through tech enabled tools.

What about you?

It’s important to start thinking about growing and diversifying your money, beyond making it and saving. Career growth will typically mean more options about where to put your money.

There’s endless content about how investing can be accessible, easy and digitized. But let’s be realistic, what does that really mean? What are the available options, and how do you actually get started?

Today, we’ll be shining a Bitesize Spotlight on Digital Wealth Management. A hint? It’s a lot savvier than just putting your money in an app.

The Basics

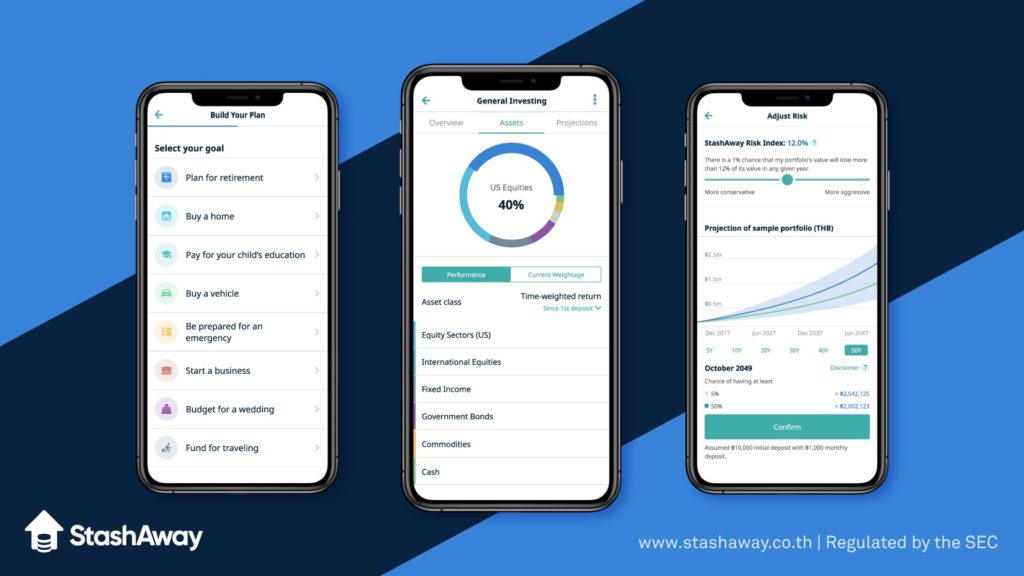

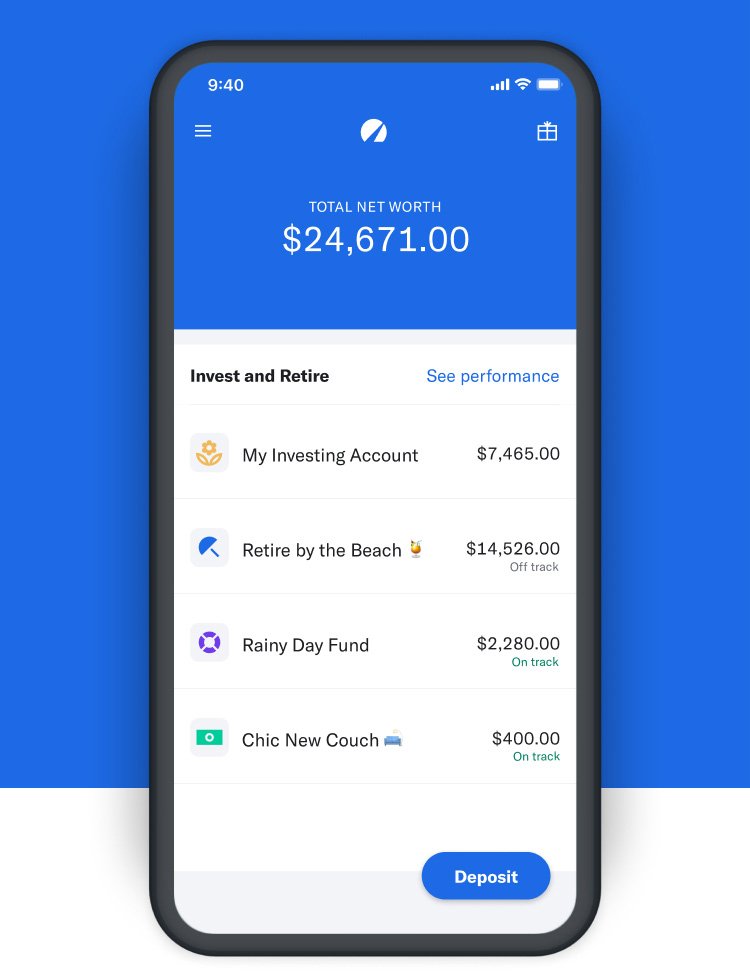

Digital Wealth Management is likely a term you have come across before. However, it’s not as simple as having an app manage your finances. These platforms make it possible to start investing, regardless of whether you start with 1,000 baht or 100,000 baht, and they typically require you to own a smartphone.

Digital Wealth Management is not as simple as having an app to manage your finances though, these platforms are typically highly sophisticated, with technology enabled backends to power algorithms that help you achieve your financial goals. The leading players in this sector are spread out across continents, from US based Betterment, or Wealthfront to Asia Pacific’s StashAway.

The winning combination of providing access to global financial products, transparent and low fees combined with a very reactive framework of asset allocation is already becoming the next frontier of investing

This kind of reactive approach allows Digital Wealth Management platforms to leverage macroeconomic data (inflation, unemployment data etc) to manage your risks whilst also maximizing returns with a specific threshold.

This is a real world example of the above: StashAway’s investment framework, ERRA (Economic Regime-based Asset Allocation) may sound like a mouthful, but it simply follows three key pillars; assessing macro data, assessing risk as well as assessing valuation gaps to deliver an effective fund picking strategy.

To sum it up, the foundation of any functioning Digital Wealth Management platform goes beyond just automated stock picking. An effective approach combines a proactive strategy, leverage technology for data and risk assessment to maximize clients return.

With that in mind, let’s dive in.

The Product

So, we covered the basics of what a Digital Wealth Management platform does. But, what do we mean when we talk about investments? Let’s take a look at the common investment products offered by these platforms.

Typically, platforms such as Betterment and StashAway offer access to diverse ETFs. Why? They offer broad accessibility, range, flexibility at good cost.

ETF assets and inflows increased in 2021, with ETFs in the US alone climbing 19% from the end of 2020 to US$6.37 trillion.

Most ETFs are index funds, aiming to deliver the performance of a stock, bond or commodity index without the hefty fees attached. The diversified nature of these ETF funds means that its an ideal pick for Digital Wealth Management platforms. As a client, you’ll have exposure to a wide range of global funds, not just be restricted by your home market or highly conservative bonds.

For example, StashAway offers access to iShares Core S&P 500, which means the fund will have a mix of mega US companies shares, from Apple to JP Morgan and Warren Buffett’s Berkshire Hathaway.

In the US, Betterment offers clients access to climate-conscious ETFs and even social impact portfolios that support gender equality driven companies. Its competitor, Wealthfront also offers access to ETF funds with low fees.

Benefits of Digital Wealth Management

Access to global financial products

Local Banks offer bundled financial products such as mutual funds, bonds and also ETFs. However, they also come with high front end fees at a range of 1-1.15% as well as high total expense ratio, as well as a non reactive investment style. This means that some may begin to look for alternatives.

Wealth management platforms such as StashAway offers Asian clients access to diverse ETFs across 35 classes, from equity sectors such as healthcare to energy, to international equities such as emerging markets. The outcome? The funds typically outperform the same risk benchmarks.

StashAway also offers fractional shares, which refers to when you own less than one whole share of a company. Fractional shares allows the platform to have preciseness in asset allocation, so that each one maintains the set risk and returns set by the client. It also provides access to high-priced shares that would otherwise not be accessible without a large deposit.

These benefits are readily available, regardless of how much you put into the account.

Transparent & low fees

One of the shared perks across all Digital Wealth Management platforms are transparent, low fees without hidden costs. This puts it on the opposite spectrum to a bank, for example. Platforms like StashAway for example, operates on one simple fee structure

For example, if you invest 500,000 baht, the company only charges an annual fee rate of 0.8%.

How can these platforms afford to be kinder on fees? The answer is straightforward; they’re supported by technologically enabled solutions which creates efficient investing frameworks and subsequently drives lower overhead cost.

Each platform will have its own investment framework that will allow companies to maintain its lower fees, automated technology enables platforms to re-optimize clients’ portfolios with high efficiency, without the manpower. It also has something to do with the nature of these ETFs itself, particularly when it relies on algorithms with no human bias.

Real Time Re-Optimizing & Re-Balancing

Let’s be honest, locally bundled funds presented to you by local banks are somewhat tiring, and it’s difficult to maximize returns when Thailand’s economic conditions suggest otherwise. Although it’s better than letting your money sit in the bank, shouldn’t you have more options when it comes to building wealth?

By leveraging a proprietary asset allocation framework, whether its US based Wealthfront or APAC’s StashAway, re-optimizing allows platforms to quickly react and leverage macro data to optimize return for clients, all by minimizing risk. The secret sauce is in the ability to monitor and adjust to real time world events and conditions, which is the key in passive investing.

Re-balancing runs daily, and means that the platform will check their clients’ portfolio holdings against their target allocation. If the target exceeds beyond threshold, a platform like StashAway will automatically and easily rebalance it back to the set target allocation.

Tackling Barriers

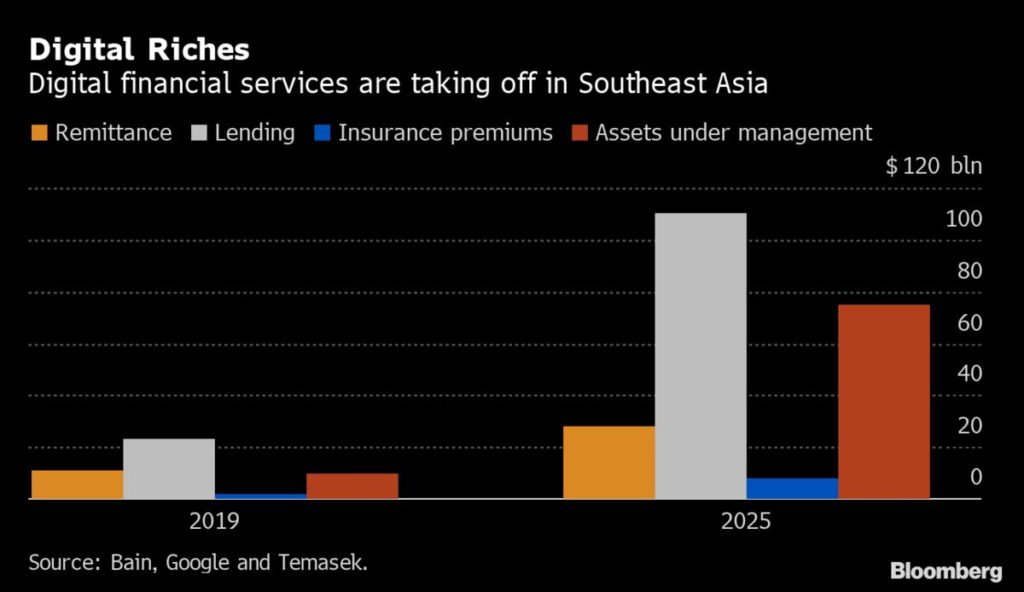

Source: Bloomberg Quint

Simplifying Complexities

One of the most common barriers to investment products is its complexity. The product itself, terms, volatility, access and more are often cited as barriers for the average person without experience. When you onboard onto a Digital Wealth Management platform, the application process initially only requires your basic information and your email address, identity verification, standard regulatory questions and your investment goals/risk appetite.

One of the key benefits is that you can start with whatever amount you’re comfortable with, and then go from there. There’s no minimum amount, no three months track record of accounts and no paperwork.

Of course, always make sure the platform you are signing up for has the necessary license to operate from say, the SEC.

Removing the Home Bias

When you invest with Digital Wealth Management platforms, there’s limited product bias from advisors, the best product isn’t incentivized by anything other than it being the most suitable product for your goals and risk appetite, and the funds itself has already been pre-selected by the platform.

Managing Risk

We would say that risk management remains one of the most significant factors to consider, even before you begin investing. Although it’s obvious to point out that all investments come with its own set of risks, operating a technologically sophisticated framework would allow the platform to sustain a client’s risk profile throughout changing market conditions or shifting macroeconomic environment.

The technology was built to re-balance and re-optimize. We took this example from StashAway’s strategy; earlier this year, the US economy was shifting towards inflationary growth, whereas other markets were heading towards the opposite.

Why is this relevant? Well, inflation-adjusted growth is the key driver of returns in the medium and long term. Therefore, StashAway actually re adjusted its investment framework to suit these macro trends. The company shifted allocation to assets that can both seize the growth opportunities in the new economic regime and effectively manage inflation; more exposure to Consumer Staples and made new allocations to commodity-exporting countries.

The Bitesize Verdict

Our bottom line is that as you grow and (hopefully) accumulate more savings and grow your net worth, it’s time to realize that investing and understanding your finances is as important as making money. Digital Wealth Management platforms enable you to mitigate your risks, whilst maximizing your returns and exposure to global investment products at no minimum cost.

Your money journey should be an on-going self education process, but it starts by learning about which platform works for you. We’ll be bringing back our Bitesize Finance editorials in the near future, so stay tuned for money related content to help you reassess your financial health.

Disclaimer: The views reflected in this article should not be treated as financial advice. All investment carries its own risk.