For all the times 2020 tried to break us, such chaos did little to knock down digital assets. Bitcoin smashes another milestone as it breaks through its all-time high – surpassing its bull-run in 2017!

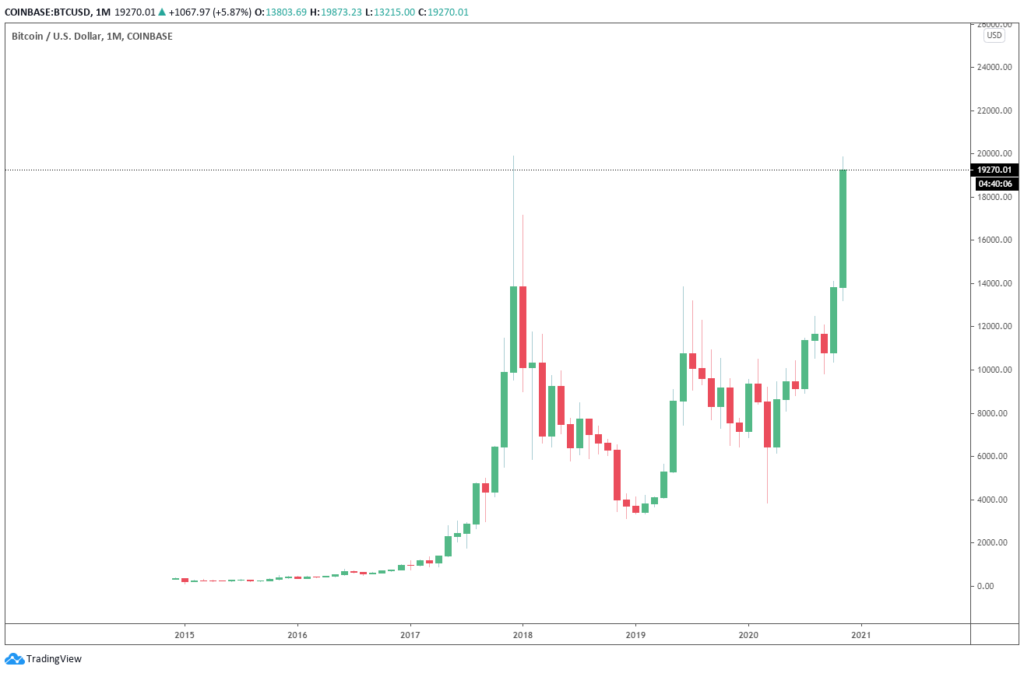

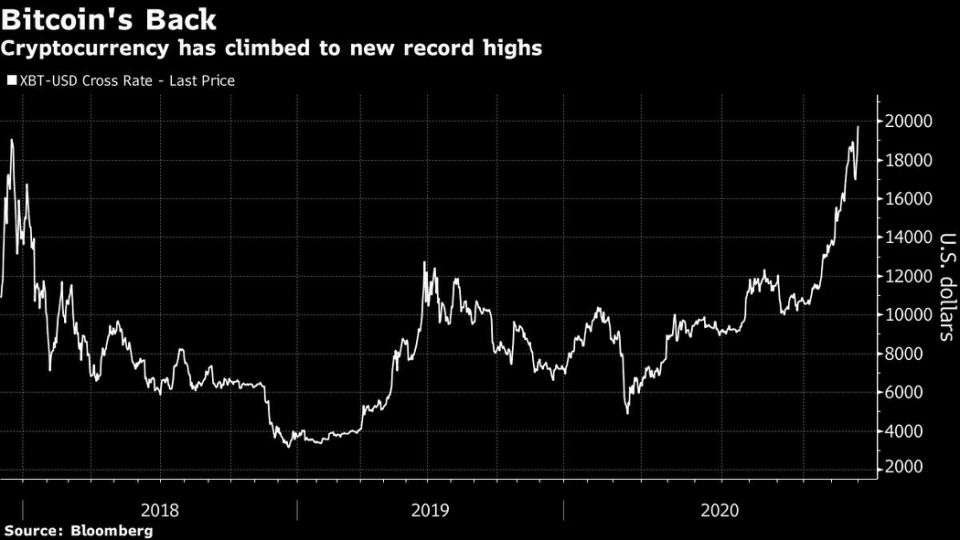

The past week has been somewhat an exhilarating ride for bitcoin as the digital currency got our juices going as it teases and rallies its previous all-time high record. Fast forwarded a week later, bitcoin breaks through its record high bull run in mid-December of 2017 ($19,666) on the morning of December 1st at $19,918 (Bitstamp ATH).

This all-time high surge marks one of the strongest recoveries in the history of digital asset market of 417.4% from its lowest point in March this year as bitcoin price plummets to $3,850 due to the outset of the coronavirus pandemic.

This latest soar somewhat differs from its previous peak in 2017 whereby the far east investors steered the course of the quick rise and fall of the value of cryptocurrencies – the momentum disperses as people question the purpose of the asset.

As time passes and awareness of the subject rises, bitcoin becomes less fueled by speculative impulses of copy and paste orders, but ignited by the recognition its exceptionally high potential returns relative to the risk tolerance. In short, the days of bitcoin being just a margin investment are over.

Bitcoin has developed to become an alternative asset for investment – it has grown to become a part of portfolio for wealth generation.

This time, it’s different.

As time passes and awareness of the subject rises, bitcoin is less fuelled by speculative impulses of copy and paste orders, but ignited by the recognition its exceptionally high potential returns relative to the risk tolerance.

With safe assets like government bonds yielding close to zero, investors have been more willing to place bets on risky assets. Bitcoin’s gains have been fueled by both retail and professional investors, and a plethora of platforms that make it easy to trade cryptocurrencies. From US stock trading apps like Robinhood, to Thailand’s Bitkub and Zipmex.

In short, the days of bitcoin being just a margin investment are over. Bitcoin has developed to become an alternative asset for investment – it has grown to become a part of portfolio for wealth generation.

However, this does not answer the hard question – what really drives this long rally? Is such performance exclusively for bitcoin? Here are a few reasons for its rebounds to fame.

- Institution money is the engine behind the rally as a wave of investors buy in for potential big profits in the asset. Bitcoin has skyrocketed to mainstream adoption in both investors and financial institutions. PayPal’s accommodation of Bitcoin in the late October increases the value of bitcoin as such a move represents the biggest leap any cryptocurrencies has made towards mass adoption throughout its 10 years of existence.

- Normalized gold narrative for bitcoin gains investors trust as rising inflation and negative views on modern monetary policy propels investors to seek for alternative safeguard for their capital. Bitcoin is following the footstep of gold – it is a speculative investment as oppose to stocks and bonds as they as based on interest payments and earnings. Bitcoin is set to become one of the key players in investors’ asset allocation as a long-term value investment.

- Global access alternative to modern central banks is one of the function of Bitcoin as it inherits the features of major sovereign currencies – secure store of value, costless medium of exchange, and borderless and stable unit of account, despite its high price volatility compared to traditional fiat currencies. Central banks across the globe are considering sovereign digital currencies as it has the potential to facilitate systematic and transparent conduct of monetary policy.

Time plays an important part in the development of bitcoin in terms of value and confidence such that the rallies in 2017 and 2020 are driven by completely different factors.

The 2020 rally is stronger and backed by smart money as oppose to margin investment in 2017. It is clear that the implications of blockchain and cryptocurrency are the backbone of the future of money and trade as the argument for the economic movement towards to decentralization strengthens.

Not to say that bitcoin isn’t still highly volatile. That volatility was on display during the week encompassing the Thanksgiving holiday, during which the coin got within $7 of its previous high only to lose $3,000 within a two-day span.

With high confidence in the market backed by smart money, bitcoin’s slip back after hitting its all-time-high could imply a potential attempt of preparation to hit an even higher record.