It just keeps getting higher and higher, there’s a new headline every week of bitcoin surpassing its previous “all time high”. If we take a look at the all time low in March and compare it with the data from last Friday (18.12.20), bitcoin has surged by 530%, with the price at THB686,500 (referenced from Zipmex Digital Asset Exchange).

So if we go by global standards, bitcoin has surpassed the US$20,000 mark and shows no sign of slowing down.

The surge in pricing has led the other altcoins to reap the benefits as well, with some currencies going even further than bitcoin itself.

The US Federal Reserve expects to leave interest rates near 0 for several more years, which further incentivizes investors to keep pouring money into bitcoin.

A little while back, we wrote a piece on the various contributing factors to Bitcoin’s price surge. One of the key factors lies with institutional investors, who’s interest in bitcoin is legitimizing the fundamentals within the industry, taking it away from just being another safe haven during uncertain climates.

The key thing to keep an eye out for in 2021 is the extent of Fund Flow for the industry. Bitcoin’s latest All Time High came from the amount of transactions and movement from institutions. Here are some institutions that are venturing into the digital assets space:

-

Standard Chartered

Standard Chartered has teamed up with Chicago based Northern Trust to launch a cryptocurrency custodian.Once approved, the new company will provide custody services for bitcoin and ethereum, initially, with litecoin, bitcoin cash and XRP to follow, targeting institutional clients who invest in digital assets, as well as family offices and asset managers who want to venture into the space. The partnership was announced earlier this month and is pending regulatory approval in the UK.

-

DBS Bank

Singapore’s DBS Bank is gearing up to launch its cryptocurrency exchange in the near future. The platform would provide tokenization, trading and custody services to institutional and accredited investors in Southeast Asia.

DBS said Singapore Exchange will take a 10% stake in the digital exchange, while the rest will be owned by the bank.

The exchange plans to use blockchain technology to provide a platform for fundraising through asset tokenisation and secondary trading of digital assets. Tokenisation basically means converting rights of an underlying asset class into unique digital tokens. For example, real estate, paintings to shares in an unlisted company can all be tokenized.

“I believe that the time is right for this (digital assets) industry to increasingly find partnership and sponsorship from the formal banking sector,” said DBS Chief Executive Piyush Gupta to CNBC.

-

Julius Baer

Switzerland based Private bank Julius Baer is teaming up with licensed crypto bank SEBA to provide its high net worth clients access to SEBA’s services, which covers trading, crypto asset and wealth management and so forth.

Ultimately, the rally in digital assets is polarizing opinion, given Bitcoin’s history of boom and bust. Bullish investors see that cryptocurrency is muscling in on gold as a portfolio diversifier amid dollar weakness and potential inflationary pressure. Those who are skeptical, are waiting for a bubble burst. However, the signs from longer term investors such as asset managers and family offices are suggesting the surge is different, but that doesn’t mean newbies should go all in on digital assets.

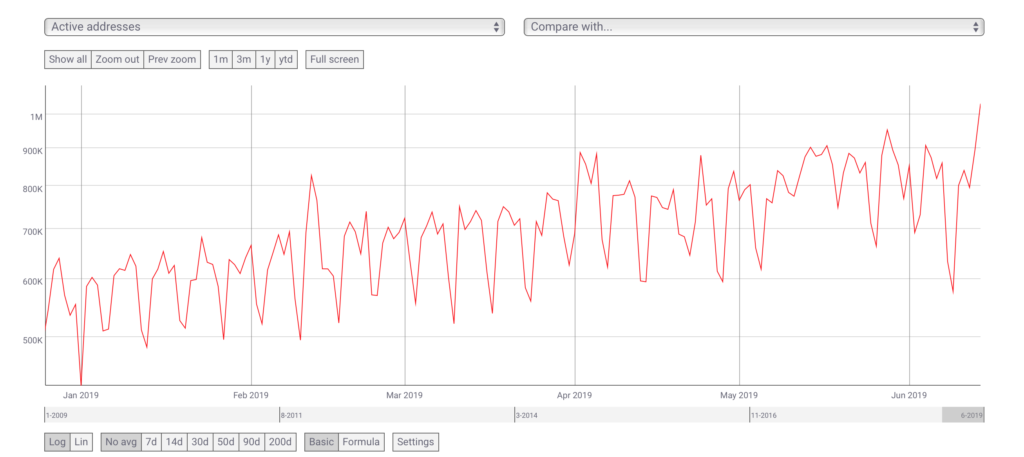

Surging daily active addresses

Address in this context refers to the transaction amount in bitcoin wallets. Currently, there are over 1 million daily active addresses. The exact number isn’t known, and this figure is from 2019, so it could be subject to some change. This number shows the actual unique transfers separate from the various direct transfers to and from bigger exchanges.