It’s become a social norm for Thais, further exacerbated in the post-pandemic reality; crowds of delivery men sporting dark green jackets, one hand clutching a smartphone and the other holding bags of highly sought after pastries and whatnot.

We know them as lifesavers, most of the time. On-demand delivery men from the likes of Grab, Lineman and now most recently, Gojek-an Indonesian import that previously went by the name GET in Thailand.

Bitesize managed to steal some valuable time away from Gojek Thailand’s General Manager, Pinya Nittayakasetwat, and picked his brain on a range of things, from the crowded delivery market in Bangkok, to market consolidation and the post-covid transition.

The Go-jek magic

The first question to get things out of the way? Why launch with GET in the first place? And was there a strategic impact?

“We needed to leverage the global brand,” says Pinya. “We wanted to launch a new player in the market back in 2019, one with a local name and a local story at first.”

“By changing the name to Gojek and essentially becoming a part of the ecosystem, it’s allowed us to move quickly with different technical upgrades and interface design,” says Pinya.

“We are able to create a good user experience as well as onboard new features quickly. The main thing is we wanted a whole new upgrade. The upgrade comes with a new level of scalability as well as efficiency.”

The proven success of Gojek Indonesia’s platform allows Gojek Thailand to be more sustainable.

Currently, users can pay for services on the application via GoPay, Gojek’s payments integration that allows you to simply top up your credit via mobile banking app. For example, if you’re currently using SCB Easy, simply just click ‘top up’ – select GoPay and go from there.

Pinya says credit card integration is on the way, too.

“We wanted to initially launch with only GoPay in order to make it easy and accessible to everyone.”

GoPay & Financial Inclusion

Gojek currently serves 38 million monthly active users (as of November 2020) across Southeast Asia, and introduced a lot of users to financial services, especially those who were unbanked. From lending to insurance, it’s been laying the groundwork to become one of the leading financial services platforms in the region.

This is why Gojek succeeded in Indonesia, because it essentially became a one stop shop for every modern user, a super app of its kind.

“Gojek in Indonesia became the leader in financial services, and contributes 40% of total e-payment transactions in the country. The ecosystem built by Gojek and further enabled by GoPay allows over 900,000 merchants to thrive and 97% of it are Micro-Small-Medium enterprises,” says Pinya.

“If there is a player in Thailand that can onboard 97% of SMEs onto their platform, that will be an incredible achievement.”

“Our GoPay tech stack is well positioned to serve the Thai market. There’s no denying that in order to run an application of this scale in Thailand, banks have to be our friend, which is why we have struck up a partnership with SCB.”

It’s worth noting that SCB has since rolled out their own food delivery platform, Robinhood.

“We are doing the building blocks and laying down the groundwork for Thailand. Gojek didn’t become a super app in Indonesia simply because it offers so many features, it became a super app because it solved so many problems with technology. We aim to do the same and use technology to solve pain points.”

Locality Wins

When asked about how Gojek manages to retain its competitive edge in a crowded market, Pinya said, “we are constantly evolving to market needs. By shifting from GET to Gojek, it really helps us move rapidly. “We have become the fastest growing O2O platform in Thailand.”

Nevertheless, the market landscape is pretty cut throat as a lot of competition is contained in Bangkok for now.

“Currently, user penetration for food delivery is at 14% in Thailand, compared to mature markets like Singapore where it’s 44%. This tells us that there’s still a lot of room to compete and grow, despite there being multiple big players in the market.”

Pinya advocates for healthy market competition.

“At this stage of the market, it’s great to have many competitors-from Lineman to Grab to SCB’s Robinhood. Each player brings something of their own to the table”

For Pinya, Gojek is a platform that continuously identifies and rectifies problems, it’s a constant re-learning process.

“Today, we have a very clear understanding of the Thai user landscape. We have a good idea of what merchants prioritize, what promotions and needs customers look for.”

For example, Thai customers often have their must-order dishes in mind, therefore there isn’t much need for an extended browsing experience. Gojek then solves this need by showcasing each restaurant’s popular dishes.

“The past learning we have been collecting, we are building it and adding upgrades onto the Gojek platform.”

An example of this is Gojek pick up service. A portion of Thai customers still like to pick up food themselves at the restaurant, and this function allows them to pre-order ahead of time before driving to pick up bowls of noodles or whatever they fancy that day.

On the merchant’s side, there is also the GoBiz platform that helps merchants manage their businesses and daily operations.

“It’s easier to upsell and cross with the GoBiz function, particularly for merchants.”

“We also have an understanding of how Thai customers think and decide on restaurants; whether they prioritize cleanliness, price or social sharing metrics, we then use this knowledge to adapt onto merchants’ profile pages.”

The learning is very localized for Gojek. “Our DNA is all about sustainable development,” says Pinya.

A Post Covid Mindset

If we look to other larger markets such as the US or China, it’s often said that food delivery is a cash burn game. The bigger your war chest, the longer you can afford to lose money, or at least that was before the pandemic hit.

“Now, investors are expecting companies to cut back as much as possible. How can you make money by losing as little money as you can? That’s the new reality that startups are facing in the Covid era,” says Pinya. “We are focused on sustainable growth, the business needs to make sense.”

Pinya also thinks about how Gojek can impact the entire ecosystem in the long term.

“I am always thinking about how we can create more income for our drivers and optimize functions for merchants.”

“The key strategy for us, is how we can improve the stickiness of the Gojek platform within the ecosystem,” he says.

Basically, the post covid environment means that businesses and founders need to think more long-term, focus on value creation and validate your business model quickly.

Market Consolidation-The Food Delivery Way?

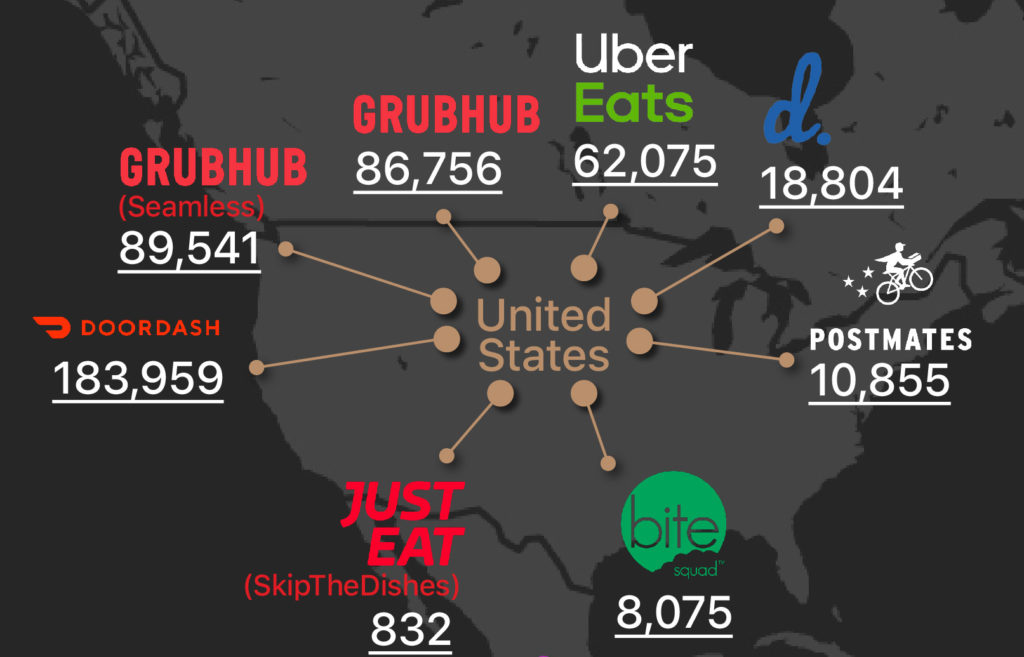

Food delivery players often turn to consolidation in order to grow or survive. Take a look at Uber for example, it acquired food delivery player Postmates back in July this year in an all stock deal for US$2.65 billion. This came pretty soon after Uber failed to acquire another competitor, Grubhub, and before Grubhub itself was acquired by Europe’s takeout giant Just Eat Takeaway for US$7.3 billion. Basically, it’s like a close knit community of friends who try to date each other’s exes.

Source: Thinknum media

There have been legitimate reports of a potential Gojek and Grab union, first reported by US tech publication The Information and then dissected by Southeast Asian tech media The Ken just last month. The math and logic is super simple; they’re both unprofitable and have spent millions (if not more) growing and capitalizing on different units, from food delivery to financial services. They’re offering the same thing to the same customer base, so why not merge?

Also in July, Thailand’s food directory ecosystem Wongnai merged with Lineman to create a whole new entity all together, and raised US$110 million worth of fresh capital to support the spin off. The takeaway? Consolidation in this space is expensive, but common.

We asked Pinya about whether he believes consolidation is the only way to win in such a crowded, competitive market.

“It’s too early to tell in our market, the landscape is too new for me to predict whether consolidation will be the route to take. As of now, it’s too soon to conclude how the landscape will evolve.”

The Post Covid Evolvement

The sweeping statement of “everything changed with covid” is in fact very accurate here. Food and grocery delivery platforms saw their businesses surge many times over as people were contained to their homes and restaurants had to close for dine-in.

We remember during Bangkok’s partial lockdown, one of the few things we looked forward to daily was what to order for lunch. Luckily for Gojek, Thais are already very accustomed to food delivery and now, even more so.

Pinya also noticed a significant change in behavior. “When we launched with GET, we competed with other players in terms of promotions. Who gave the most discounts and whatnot. Now, customers have shifted their interests-they prioritize hygiene and reliability. We have to up our game, because customers have also upped their standards and reach.”

Looking Ahead

When asked about specific pain points or learning curves for the Thai market, Pinya cites two as the biggest hurdles in Thailand; tech adoption and complacency.

“Adoption in Thailand is slower than our neighbors. It takes time to adopt and learn about a new digital platform. However, once adoption starts, it accelerates into a mass product easily,” he observes.

The second pain point? Thais are actually living rather comfortable lives in the big city. Although we have bad traffic, it’s nowhere near comparable to Jakarta. This means that the actual problems that can be solved using technology, in terms of B2C services-is well covered.

“In terms of adoption, Thais don’t easily convert to use digital services and typically have higher expectations with technology solutions. For example, the average Thai person spends 9 hours online, most of that time is used for leisure activities i.e. chatting with friends on LINE and streaming series on Netflix and Youtube,” says Pinya.

“We need to work harder in order to really make a difference in people’s daily life. The benchmark is high to become a proper digital enabler in Thailand.”

“We share the same DNA as Gojek in Indonesia, we want to make a difference to our users’ lives. The economic value Gojek brings to Indonesia’s GDP is 1% or a total of US$7.1 billion in 2019. With Thailand, we hope to make a similar impact in five years, particularly against the backdrop of an economic downturn.”

From what we’ve seen so far, we think both Pinya and Gojek are very much positioned to rise to the challenge.